how to file back taxes without records canada

If you are experiencing difficulty preparing your return you may be eligible for assistance through the Volunteer Income Tax Assistance VITA or the Tax Counseling for the Elderly TCE programs. This an affordable option to hiring a tax accountant.

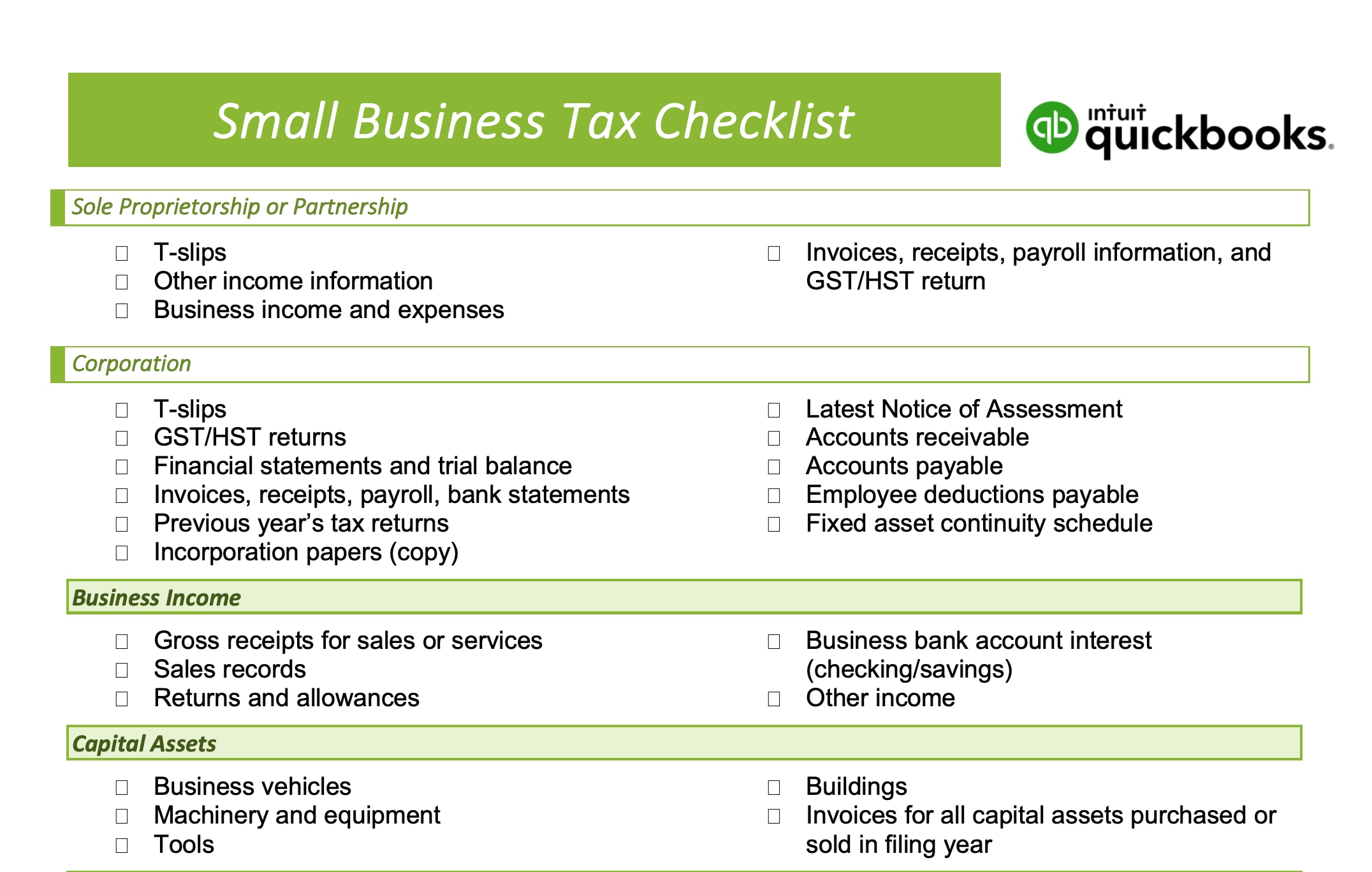

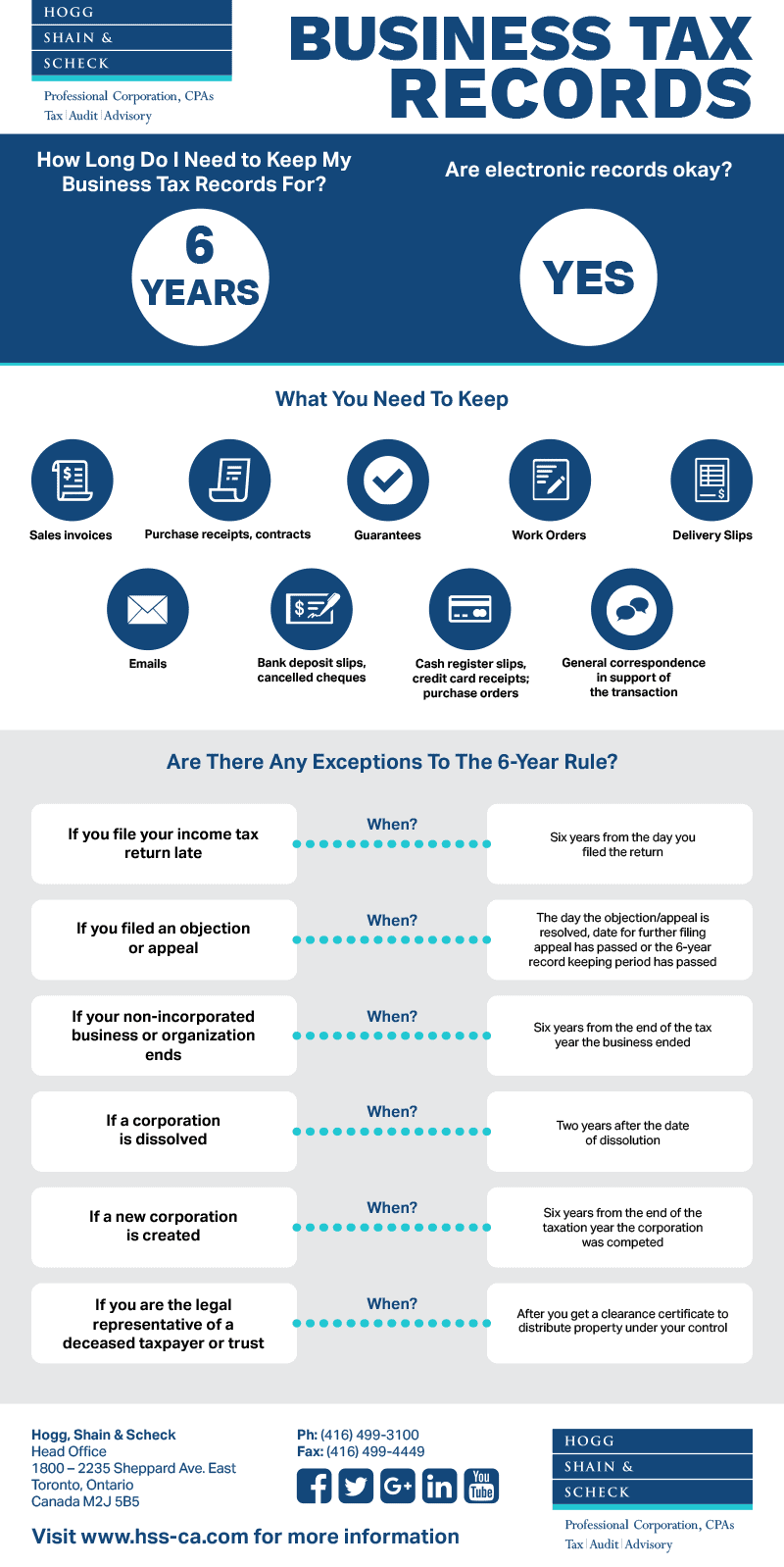

Record Retention Policy How Long To Keep Business Tax Record

Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed.

. Find out the severity of your tax situation. Dont Know How To Start Filing Your Taxes. The NETFILE and ReFILE services for tax years 2017 ReFILE excluded 2018 2019 2020 and 2021 will be open until Friday January 27 2023.

I filled out my 2015 income tax from us and Canada and i never got it. While many have federal income taxes withheld from their paychecks sometimes too much money is withheld. Have you failed to file your return for one year or several.

Federal tax returns or reports of Foreign Bank and Financial Accounts - FBARs - on time for various reasons. There are situations that alter this rule. As a Canadian taxpayer the first step to file your returns is to have CRA Access.

Find out what tax evasion means and whether it applies to you. Next you can manually complete the tax form and mail it in use commercial software to electronically file your taxes or hire a tax professional to assist you. Form 4852 is a simple single page form that is easy to complete.

Still the CRA understands the extraordinary circumstance stemming from 2020 including emergency and recovery benefits work from home credits and other financial challenges that will make filing a return difficult this year. This means that if there were several years where you did not file your taxes or did not file your taxes correctly you need to submit information on all of these years. For most taxpayers the normal reassessment period is three years.

To file back taxes start by determining which years you need to file and locating the W-2s 1099s or 1098s associated with those years. You must have the fundamental knowledge of accounting principles tax codes and. Once you have totalled your tax credits subtract them from your previously calculated tax liability to get to your final numbers.

Connect With An Expert For Unlimited Advice. Most Canadians need to file tax returns every year. My Turbo Tax information shows I am resident in NFL.

The IRS is fully aware that some US taxpayers living overseas have failed to file US. Whatever the reason if an individual or corporation received income in a taxation year you have an obligation to file. Get our online tax forms and instructions to file your past due return or order them by calling 1-800-Tax-Form 1-800-829-3676 or 1-800-829-4059 for TTYTDD.

Access the EFILE web service to transmit your clients returns directly from your tax preparation software. While it is possible to file your taxes online it isnt for everyone. While this is not general practice the IRS allows taxpayers to file their taxes using their last pay stub to fill out Form 4852 Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts Etc.

Filing Taxes Late in Canada. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. In fact some of them have recently become aware of their tax filing requirements and would like to comply with the law.

Filing Late Canadian Back Taxes for 3 Years Need Help. Tax accounting software is popular in small businesses and appears to be sufficient for personal income tax filing. Because I am in Quebec and require to file a provincial tax however I dont know how to go about it.

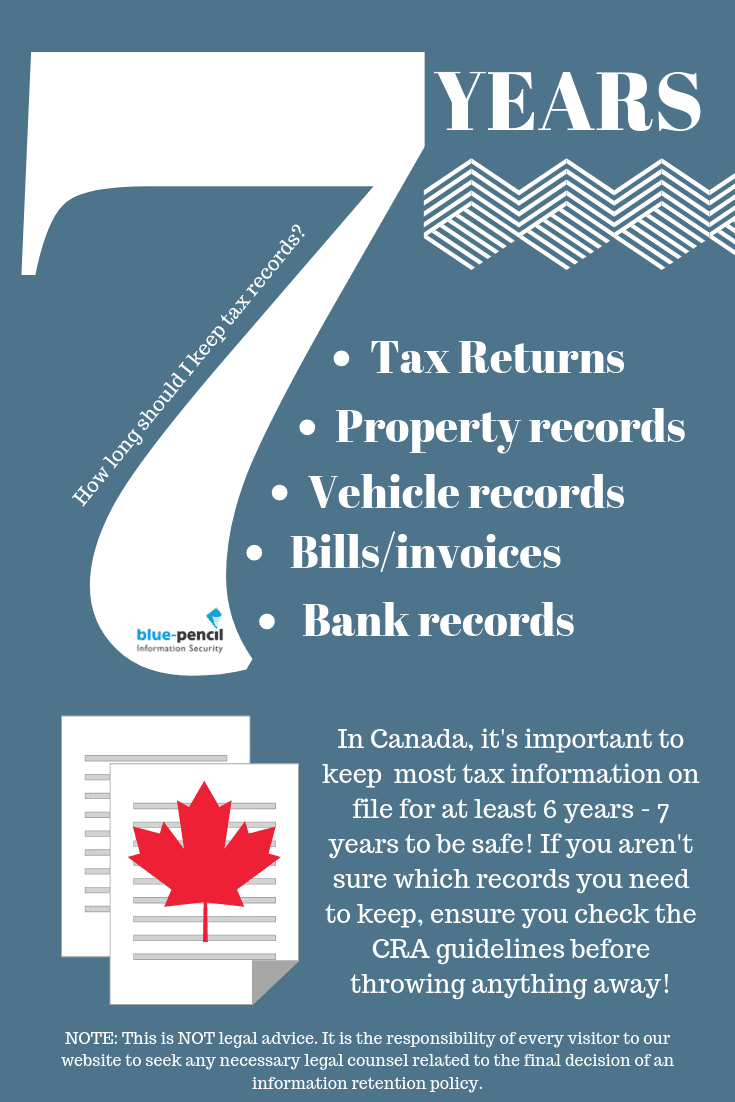

Visit the CRA website for a full list of refundable and non-refundable tax credits available in your province. The rule for retaining tax returns and documents supporting the return is six years from the end of the tax year to which they apply. Dont think that they will owe so they dont file.

Revenue Canada is mailing meher the T4s from the previous years. As a resident of Canada receiving taxable income you are obligated to file an annual T1 Income Tax Return each year. Filing back tax returns you havent completed could help you do one of the following.

In these cases filing a tax return could result in a tax. Determine whether you need to contact a tax preparer or you can handle the back taxes on your own. TurboTax has versions of the software dating back to 2007 so I could download those and to do her taxes.

The NETFILE and ReFILE services are now open for the electronic filing of your T1 personal income tax and benefit return. One practical reason to file a back tax return is to see if the IRS owes you a tax refund. However to properly use tax accounting software and learn how to file back taxes without records.

Steps to Filing Previous Years Tax Returns in Canada Do your Research. Obtain an acknowledgement of acceptance or rejection of the individual return instantly. Without further ado these are the steps to file your taxes online in Canada.

For all 2007-2010 the software will cost 250. Reduce The Stress And Minimize Your Tax Obligations With Tax Services From A Paro Expert. Use an EFILE certified tax calculation software package.

But this power is restricted to certain time lengths depending on the situation. However many Canadians fall behind filing tax returns for a variety of reasons. Know they will owe and dont have the funds to pay.

The Canada Revenue Agency is allowed to go back and look at your previous tax returns and perform reassessments if they so choose. You must disclose all undisclosed information to the CRA. For example a 2015 return and its supporting documents are safe to destroy at the end of 2021.

However without sending another assessment to me. You cant file a return from two years ago under the VDP if you also have an outstanding return from three years ago for instance. Citizens Abroad and Taxes.

How to File Taxes in Canada. Although tax filing was extended last year due to the COVID-19 pandemic the deadline remains on schedule this tax season. Make sure you check out the CRAs restriction list before you begin.

You can only file during our regular system hours of operation. If you have filed late returns the six-year rule applies to the date of. Canadian Corporations have an obligation to file annual T2 Income Tax Return.

Choose the Tax Filing Expert For Your Job With Our Easy Comparison Options.

Non Resident Tax Return Sprintax Blog

How Long To Keep Pay Stubs In Canada Blue Pencil

Here S How Long You Should Keep Your Tax Records Forbes Advisor

How Long To Keep Tax Records In Canada Why

What You Need To File Taxes In 2022 Explained Including Two Key Documents

Record Retention Policy How Long To Keep Business Tax Record

Your Income Tax Return And Supporting Documents 2022 Turbotax Canada Tips

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

Tax Season Shredding What To Keep How Long Shred Nations

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Tax Season Shredding What To Keep How Long Shred Nations

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Taxes Done Find Out Which Tax Records You Should Keep The Turbotax Blog

How Long To Keep Tax Records In Canada Why

Record Retention Policy How Long To Keep Business Tax Record

20 Common Mistakes By Payroll Companies Infographic Internet Marketing Infographics Infographic Marketing Business Marketing Plan

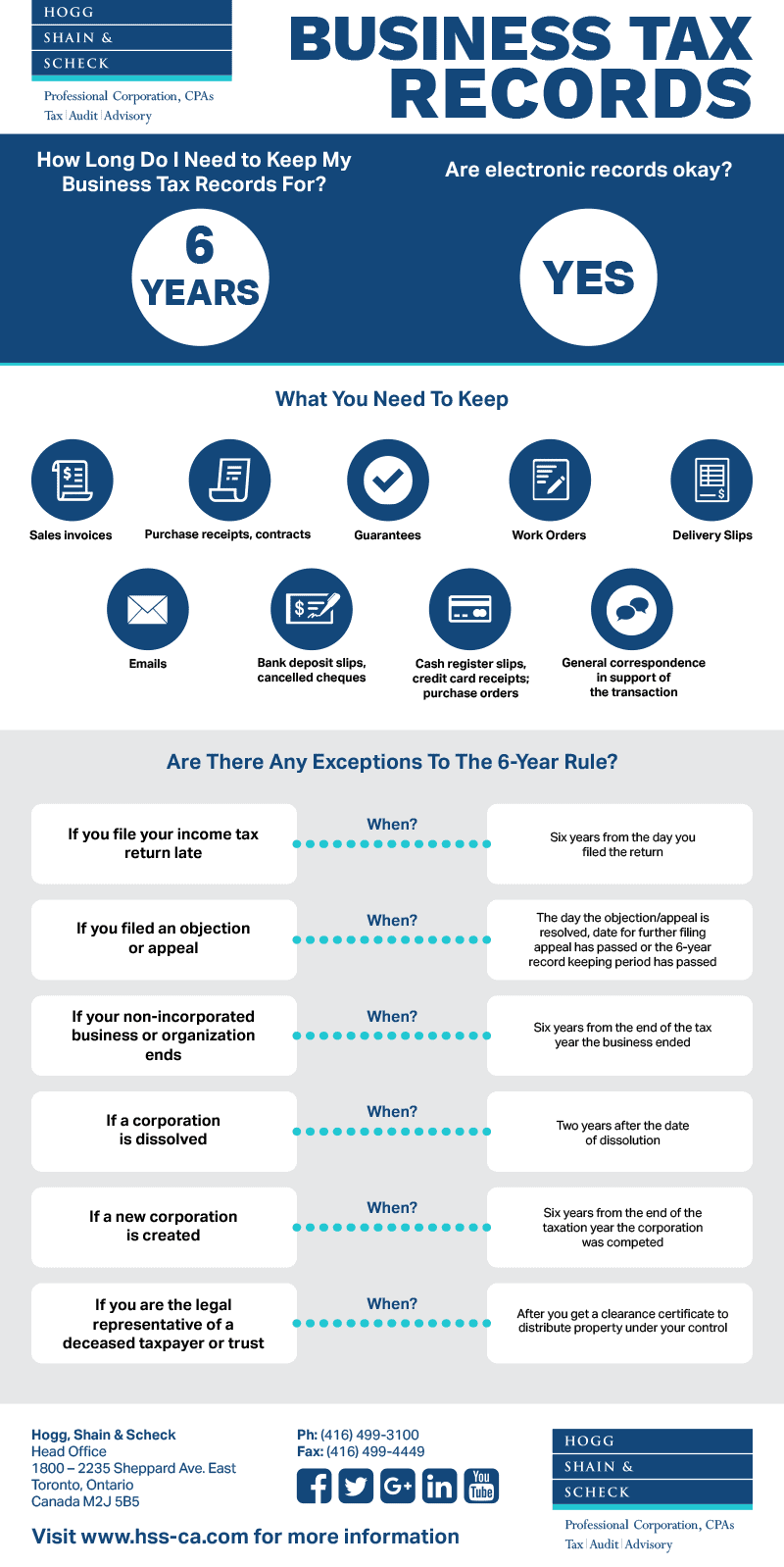

How Long Do I Need To Keep My Business Tax Records For Are Electronic Records Okay What You Need To Keep Are There Any Excepti

Alliance Of Commitmetnt V Nashem Bloge Gorazdo Bolshe Informacii Https Storelatina Com Canada Fashion Ringsgalore Photography Alliance Product Launch Blog